What is embedded compliance

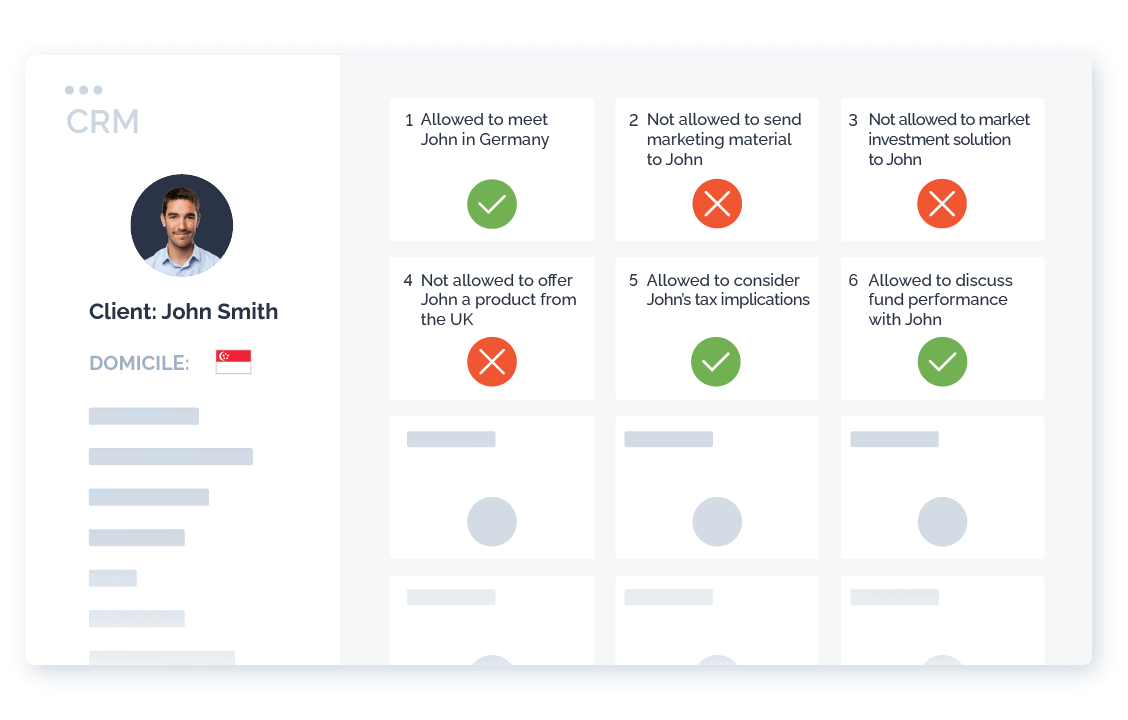

Embedded compliance is defined as the ability to provide instant answers to regulatory questions when and where they are needed – fully integrated into financial institutions’ existing infrastructure.

There are many advantages of embedded compliance

- Conduct pre-activity checks: Make compliance checks on a pre-activity basis so that compliance breaches do not occur at all.

- Replace complex policies: Replace policies with instant, accurate and actionable regulatory answers on your most pressing regulatory questions.

- Minimise compliance controls: Minimise post-activity compliance controls with compliance checks that are embedded into existing tools and processes.

- Digitise your compliance processes: Leverage embedded compliance to drive compliance innovation.

- Add-on: Embedded compliance works on top of existing systems, so you can access it anytime and anywhere.

How embedded compliance works

Embedded compliance works by unifying regulatory knowledge so it can be processed from a single repository, structuring it so it can be used in any digital channel, and integrating it with any team, tool, or process in financial institutions.

Regulatory compliance for financial services

Let’s get back to the basics by defining regulatory compliance first.

Regulatory compliance refers to what organisations must achieve to ensure that they are aware of and take steps to comply with all relevant laws, policies and regulations.

The growing complexity of regulations, increasing regulatory divergence, and heightened scrutiny by regulators have all increased the importance of regulatory compliance, but also the resulting challenges.

Financial institutions are responding to these challenges by increasing their compliance budgets and strengthening their compliance teams, leading to a decline in business activity.

The key to compliance is usually ensuring that business teams know the answers to relevant regulatory questions, even if they are not regulatory compliance experts.

Embedded compliance gives business teams immediate answers to their most pressing regulatory questions right where and when they need them: embedded in their existing systems, tools and business processes.

What are common regulatory compliance questions?

Compliance affects all areas of a financial institution, but common complex compliance questions revolve around the advisory process, the onboarding process or the trading process. Other important topics include data protection and tax.

While nearly every company has very specific questions they need to have answered frequently, there are some issues that we have identified that almost every financial services provider struggles to answer. To learn more about these, browse our use cases.

By its nature, regulatory compliance is not static, neither is the business perspective and risk appetite of an organisation. Embedded compliance ensures that financial service providers have access to and can maintain a single digital repository of compliance rules. This up-to-date knowledge is available to all of its business units in real-time.

Can embedded compliance be a business enabler?

Compliance is often one of the main barriers to the growth of financial institutions. Embedded compliance is a new class of technology that was developed to unlock the capacity inherent in any business. It enables financial institutions to accelerate growth, decrease costs and reduce risks.

When compliance is realised seamlessly, financial institutions are agile enough to adapt easily to outside forces, leaving more time to drive revenue through innovation, quality improvements and strengthening customer relationships.

The benefits of embedded compliance for businesses

Embedded compliance helps businesses find and fix the inefficiencies hampering the performance of their core activities.

By providing easier access to compliance knowledge, embedded compliance provides financial institutions with the insights they need to identify their potential for unlocking business opportunities.

There are several benefits of embedded compliance. The technology enables financial service providers to:

Accelerate growth

Having instant, accurate and actionable answers to regulatory questions empowers financial institutions to do more business with more clients in more countries. For example, serve customers instead of having to read through lengthy policies.

Decrease costs

Reduce the regulatory overhead to save money without sacrificing the commitment to regulatory compliance. For example, dramatically reduce the time spent on compliance training and post-activity controls.

Reduce risks

Clear dos and don’ts bring down the regulatory and reputational risks, not only for companies but also for employees and board members.

Focus on the business

Embedded compliance allows financial service providers to refocus on innovation and creating great experiences for their customers.

Get to value quickly and easily

Embedded compliance is easy to implement and has a short time-to-value.

Scale your business with embedded compliance

Our embedded compliance experts will show you how Apiax fits into your business. Request a demo today.