As the year comes to an end, we look back and reflect on the events that shaped Apiax in 2024. In this recap we look back at our findings, successes and new ventures and which achievements and initiatives have driven us forward.

Product improvements and innovation

Cross-border rules for over 190+ countries

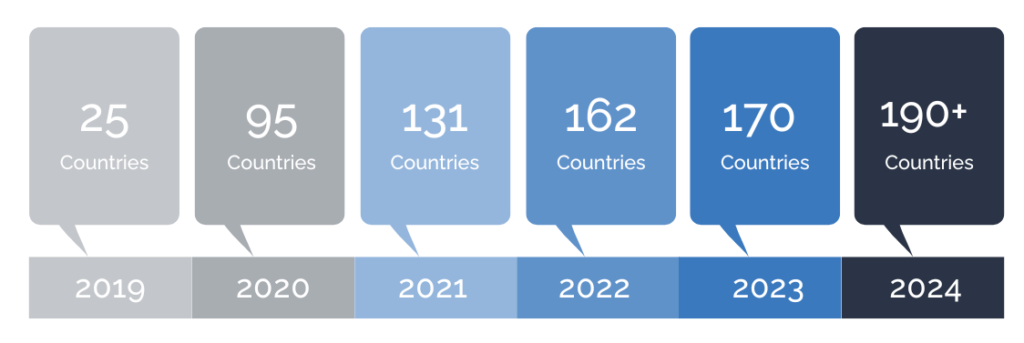

Apiax has been steadily expanding its rule repository since 2019, ensuring our users always have access to regulations across all countries—helping Apiax customers clarify thousands of cross-border situations every day.

Cross-border activities hold a large part of our digitised rule repository, as many front-office staff from financial services use our solution to search and clarify what they can or cannot offer whilst offering services across borders. Today, we proudly support compliance for over 190+ jurisdictions.

Here’s a glimpse into our growth trajectory:

Did you know? Besides wealth and asset management, Apiax also offers cross-border rules for all relevant investment banking activities for 50+ markets!

Rules provided by the Apiax Cross-border apps include services such as M&A businesses, Capital Market Transactions in the primary and secondary market, preparing and executing IPOs etc.

New Cross-border ChatBot

According to our latest Cross-border Black Book more than 50% of wealth managers are still struggling with understanding complex country-specific cross-border marketing restrictions.

This year, in addition to Apiax’ standard Apps and their yes/no results, we now have an AI-powered chatbot that enables you to access all complex cross-border scenarios directly from your desktop or mobile device via a simple conversational and responsive interface.

The Apiax Cross-border ChatBot also provides you with detailed explanations on financial and regulatory definitions and can even answer questions about your internal company’s policies. Contact us if you’re curious to try it out.

Content Compliance for sales and marketing

Content Compliance, or disclosure management as some may refer to it, is a hot topic in the industry right now, with many financial services looking for a solution in this area, as Alpha FMC pointed out in their recent blog post.

With access to an up to date digital library of pre-approved disclaimers, disclosures and additional content requirements, the Apiax solution helps streamline the creation, distribution, and tracking of disclaimers for marketing materials. This eliminates the need for static disclaimer spreadsheets and manual compliance reviews, ensuring consistent and compliant messaging across all marketing materials!

Marketing and Sales teams often lack clear and consistent guidance on regulatory requirements for their content – from pitch decks, to PRIIPs or investment brochures. That’s why we’re calling upon content creators and reviewers across the industry to get first-hand insight into the challenges wealth and asset managers across the globe face when it comes down to content compliance.

We want your input!

Partnerships and joint ventures

In 2023, we announced our partnership with Seismic, a strategic alliance that has only grown and strengthened in 2024. We were thrilled to partake in various Seismic events this year, including the latest ‘Breakfast Session’ this past September that saw UBS Asset Management’s Damaris Maimone, PhD take the stage and together discuss how financial organisations can effectively design and manage processes and the data that drive them.

At the beginning of the year, Apiax officially launched the AI Policy Assistant, supporting financial institutions to navigate internal policy queries and complex cross-border requests with ease and precision. The generative AI solution was created in collaboration with Microsoft’s Azure OpenAI services, and ensures instant, precise, and verified answers to policy queries in a dynamic conversational format.

Collaborations and findings

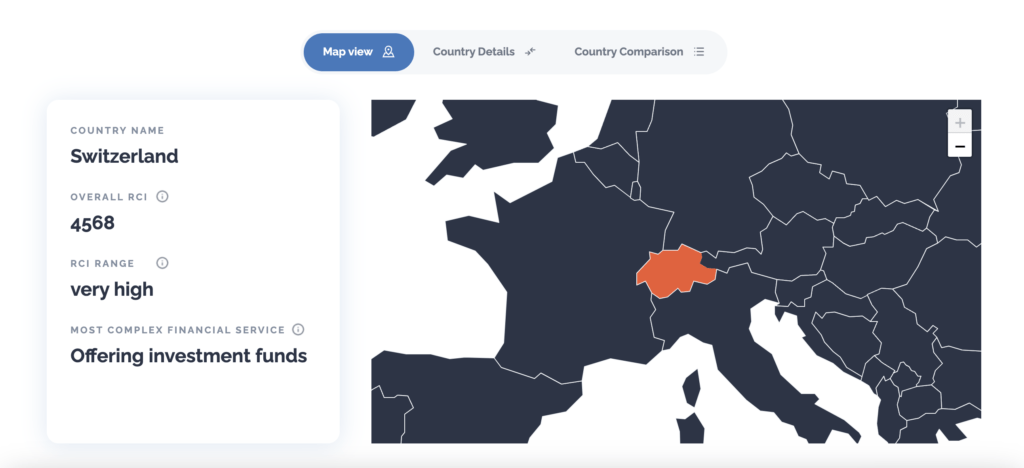

We kicked-off the year by reporting the results of our annual Cross-border Compliance Survey in our new and improved report: the Cross-border Black Book 2024. The Black Book uncovers industry insights about the challenges and opportunities that financial institutions face when managing cross-border client relations. It also explores the tools used by front office teams, the industry’s interest in AI compliance tooling, and introduces the first ever data-backed regulatory complexity calculator, the Apiax Regulatory Complexity Index (RCI).

The RCI assesses the complexity of offering financial services across different jurisdictions by analysing the number of restrictions which are imposed on a financial institution when conducting a business activity in a given country. Test it out for yourself: explore the RCI.

We also launched a new infographic outlining the differences between Rule-based compliance and a Generative AI-based framework. Make sure you download the resource if you’re keen to know about the key features that both compliance frameworks provide, their benefits and the best suitable use cases for each.

In 2024 we continued to push the ‘Embedding Compliance Unlocked: Leverage AI-enabled compliance tooling now to be ready for 2025’ white paper we launched with EY and JWG Group in late 2023. The authoritative whitepaper that explores how financial institutions can embrace AI and other technologies as part of their digital transformation journey.

As we do each year, we updated and released the 2024 version of the Embedded Compliance Guide; a guide on how financial institutions can best leverage embedded compliance to help minimise risk, reduce costs and improve efficiency; and the Ultimate RegTech Guide, a guide on all things Regulatory Technology (RegTech), from real-life case studies, how to implement RegTech solutions, links to industry-recommended associations, articles, blogs, and more!

The Apiax Newsletter

This year we continued the Apiax Newsletter with full force! We’re thrilled to have grown our email subscriber list and our LinkedIn Newsletter subscribers to over 3600+ combined, that’s almost 1000 more subscribers than in 2023!

If you’re not already a subscriber, make sure you subscribe to our email newsletter and stay in the loop on all things Embedded Compliance and the Apiax universe.

Community and events

Another year, another bunch of successful Apiax Mixer networking events! This year you saw us (and we saw you) in Singapore in May, Geneva in June and Zürich in October.

We also hosted our annual exclusive Cross-border Luncheon in May in Zurich. If you’re interested in a roundtable-luncheon with industry experts in the field, get in touch with Apiax CRO Ralf Huber—and maybe we’ll see you at the next one!

In June we were proud to participate in the recent Legal & Compliance Event organised by the Association of Swiss Cantonal Banks. This long-running event has become a cornerstone for fostering collaboration and knowledge sharing among professionals in the Swiss banking sector.

In addition to the in-person events we attended, we actively participated in Hubbis’ annual Priorities and challenges for COOs and WealthTech leaders webinar, where Apiax co-founder Ralf Huber shared his insights on revolutionising compliance in the wealth management sector.

Looking ahead into 2025

As we reflect on 2024, we look back with pride and accomplishment. This year, Apiax has reached many milestones, from new product launches, engaging with industry experts at our events, creating valuable industry content, and more.

Our unwavering focus on innovation and client satisfaction has allowed us to help our clients stay ahead of their regulatory compliance needs. We are deeply thankful to our clients, partners, and the entire Apiax community for making this year a success.

Going into 2025, we look ahead with optimism. We are confident in our continued growth and in our ability to make a lasting, positive impact on the regulatory compliance landscape.