Bank Compliance Software

Embed compliance into your existing banking tools and operations with a bank compliance software.

What is a bank compliance software?

A bank compliance software is an innovative technological solution that helps financial institutions automate manual compliance processes, with the digitisation of regulations.

All the paper-based regulatory content is digitised and managed in the form of digital rules that can be customised by compliance teams, which then need to spend less time dealing with compliance requests and ensuring compliant day-to-day operations.

Global banks are now using bank compliance software as a compliance management solution not only to scale their compliance processes and make them more efficient, but also to avoid compliance breaches.

Investing in compliance checks software reduces the likelihood of human error and makes it easier for all teams to get regulatory questions answered quickly.

Regulatory technology is empowering organizations with the tools required to drive efficiency and sustainability in their regulatory compliance functions.

Banks compliance policy: the need for automation

Legal and compliance teams play a key role in defining and executing a bank’s compliance policy. However, the fast-paced regulatory environment makes it a hassle to keep up with the latest rule changes and mitigate any compliance risks.

Compliance professionals spend on average 10 hours per month solving cross-border compliance issues only. There’s an urgent need for a digitisation of compliance that relies on automation, to strengthen banks’ compliance frameworks.

Efficiency in compliance management is often threatened by series of factors that compliance officers have no control, for example:

- Ever-changing regulations

- Relying on external legal providers

- Post activity compliance checks

- Paper-based regulatory content

- Time spent with compliance monitoring

- Non-scalable compliance processes and workflows

Embedded compliance: the new bank compliance software

A bank compliance software helps financial institutions of all sizes to operate compliantly by managing regulations in a digital format. It gives compliance teams the chance to automate some of their bank compliance procedures, which is directly linked to a decrease in human errors and non-compliant activities.

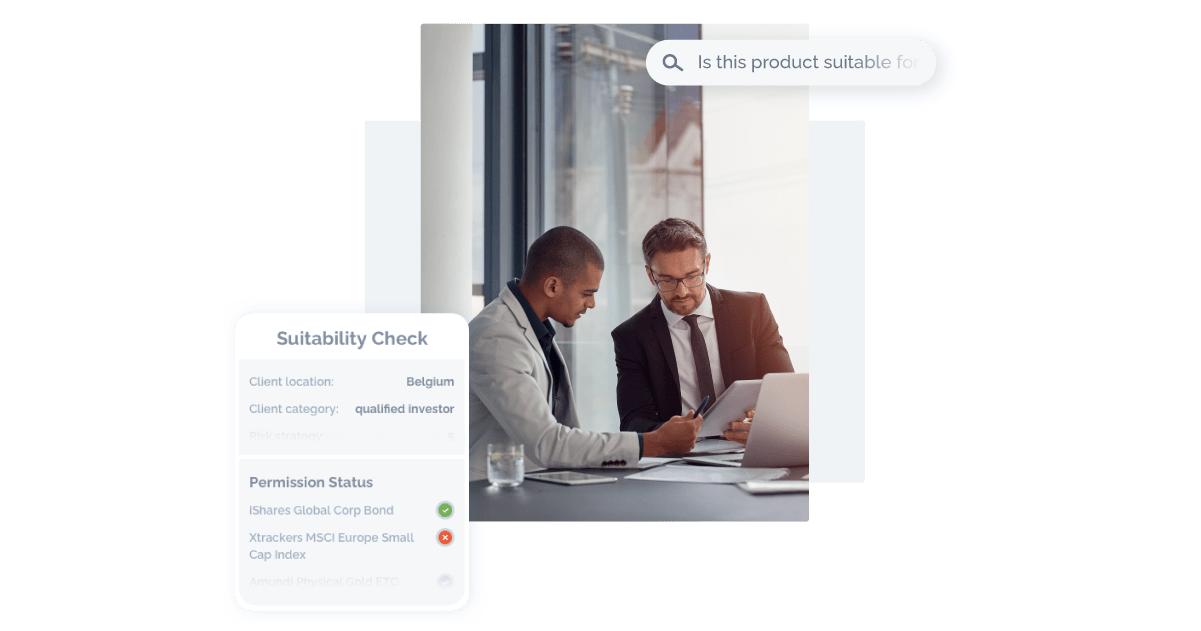

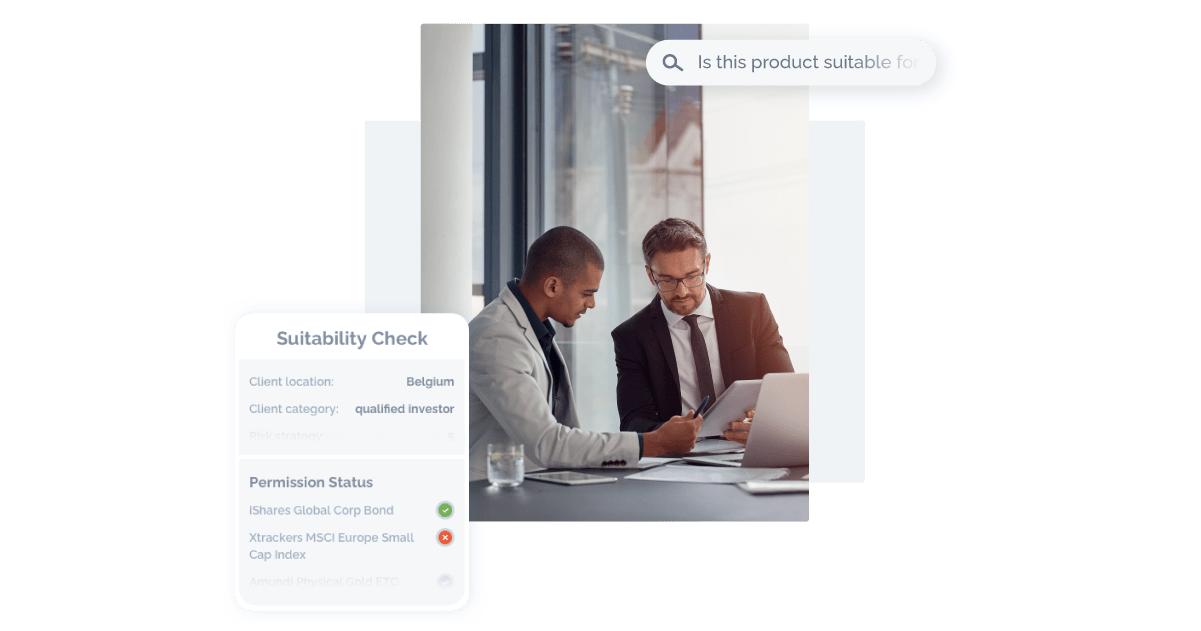

Apiax bank compliance software uses embedded compliance. It’s a digital-first approach to regulatory compliance for banks that allows them to keep working with their existing tools and get compliance checks on the go.

While traditional compliance is heavily dependent on an extensive human analysis of documents that take forever, you can find the answers in a few minutes with a bank compliance software.

Embedding compliance into daily operations benefits the efficiency of the entire organisation and it’s done via a lean integration with the existing banking systems in use.

By providing regulatory answers right when and where people need them, embedded compliance:

- Reduces dependencies on the legal & compliance teams

- Minimises compliance risks

- Contributes to a faster go-to-market

How a bank compliance software works

There are a few bank compliance software solutions in the market so it’s necessary that you take some time to assess how robust, secure, and easy to use their solution is.

Apiax bank compliance software was created to be compliance-first and API-first which facilitates the integration with your current banking system or CRM. We provide a trial access for your IT team to experiment and clarify any questions upfront.

All the regulatory content is sourced from one of the world’s leading law firms that we proudly have as partners. You get to choose with which content partner you want to work, to make sure you’re complying with the compliance auditing best practices.

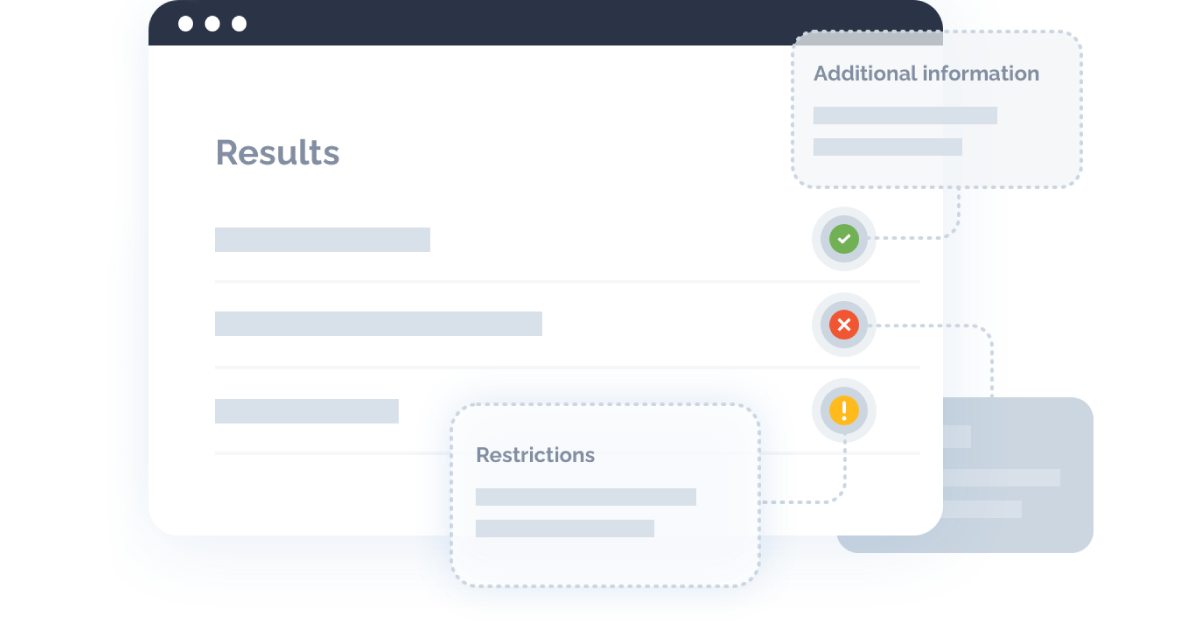

Depending on your compliance monitoring program, we also allow compliance teams to create their own digital compliance rules. The end go is to have immediate access to up-to-date regulatory content, on top of your existing operational tools— frictionless, easy to use, and no additional hardware is required.

- Access regulatory content maintained and verified by the world’s leading law firms.

- Adapt regulatory answers to your own risk appetite and business needs.

- Embed compliance into any team, tool or process for fully compliant business growth.

Why are financial institutions investing in bank compliance software?

A bank compliance software comes as a great RegTech solution for global competitive financial institutions, as it enables them to scale their business operations with less compliance risks.

Wealth managers, asset managers and relationship managers have access to regulatory questions in real-time. Business teams can save time and drive more deals, faster.

For legal teams, having a bank compliance management software in place helps digitise those dense country manuals and other compliance processes, but also to decrease the bottleneck in compliance officers for every compliance question in the whole organisation.

Financial institutions are implementing embedded compliance as a bank compliance software to remove the complexity from regulatory requirements. This way, business teams can focus on generating more revenue.

Looking for a bank compliance software?

Request a free demo today and find out how it suits your business.