Digital Cross-Border Compliance: The Definitive Guide

All you need to know about mastering cross-border compliance in the digital age.

Cross-border compliance: definition

What is cross-border compliance? What is digital cross-border compliance? Let’s cover a few important definitions at the beginning.

What is cross-border compliance?

Business activities across borders have always been an important pillar of the financial industry. These activities are subject to extensive controls in an increasingly stringent regulatory environment and involve significant legal and reputational risks. Financial institutions with an international customer base are confronted with a variety of country-specific regulations. Strict compliance with these local provisions is a key issue for any financial services provider. We refer to this as cross-border compliance.

What is digital cross-border compliance?

Whenever financial institutions aim to solve their cross-border compliance issues by digital means, we refer to this as digital cross-border compliance. The potential solutions in digital cross-border compliance are manifold, from horizon scanning solutions to regulatory change management or embedded compliance solutions such as Apiax’s.

5 developments that drive interest in digital cross-border compliance

There are at least five developments that make digital compliance solutions more urgent than ever. Let’s take a brief look at all of them.

1. Increasing regulatory complexity

The demand for compliance capabilities has grown significantly in recent years, according to the Thomson Reuters Cost of Compliance Report 2022. The regulatory environment has diversified, with developments in many areas, including crypto-assets, fintech, artificial intelligence, third-party vendor management, operational resilience and cybersecurity. The range of regulatory issues where compliance is expected to provide assurance to executives has increased.

2. Divergence of financial regulation

More regulation goes hand in hand with more divergence of regulation, an issue explored in this report by the Organisation of Economic Co-Operation and Development (OECD) and the International Federation of Accountants (IFAC). The challenge is clear: the report shows that the cost of regulatory divergence was significant or very significant to the financial performance of 75 per cent of the institutions surveyed. 71 per cent of respondents indicated that these developments were an obstacle to expanding their business to new jurisdictions.

3. Increasing competition in the financial industry

With a whole range of new competitors, the stakes have never been higher in the financial industry. Efficiently dealing with cross-border compliance allows financial institutions to remain agile and competitive – expanding into new jurisdictions, products or services effortlessly – enabling them to realise their full business potential.

4. Increased scrutiny from financial regulators

Financial regulators are supervising cross-border issues of their regulated institutions more closely than ever before. One of the biggest risks in the view of financial institutions is being sanctioned by the regulator of the target country. The Swiss Financial Market Supervisory Authority (FINMA) has been particularly explicit about this (see here and here), but other regulators have been doubling down on their efforts, as well.

5. New compliance challenges

Hand in hand with new regulation, we see new compliance issues gaining traction. Whether it’s FCA consumer duty, cryptocurrency regulations, or the regulatory implications of remote workplaces and customer meetings: All that’s certain is that there will continue to be new issues to absorb in the future.

3 consequences of not dealing properly with cross-border compliance

Financial institutions that are unable to effectively manage cross-border compliance not only face fines, penalties, and unnecessarily high operating costs, but also run the risk of missing out on important business opportunities.

1. Financial services fines and penalties

A major challenge in today’s environment are the fines and penalties that loom behind every corner for financial service providers. Since 2000, financial institutions have been fined more than $344 billion USD. And while we can see some positive signs more recently, the general consensus is that the numbers will increase. So the challenge is clear: to find new, technology-enabled ways to ensure compliance, especially in cross-border financial services.

2. High operating costs for banks

Governance, risk and compliance (GRC) functions account for 15 to 20 percent of a bank’s total operating costs. Between 10 and 15 percent of the total staff of an average universal bank is responsible for GRC. To put things in another perspective, 4 to 10 percent of a bank’s revenues are typically spent on compliance costs. In short, smart and efficient compliance practices can have a significant impact on the business prospects of financial institutions.

3. Missed business opportunities

To keep their cross-border risk under control, financial institutions today often respond by not expanding their operations in certain countries or even by withdrawing from them. Similarly, financial institutions are limiting their product and service offerings to ensure that they comply with all applicable laws. This makes it abundantly clear that those financial service providers that have found an efficient way to manage cross-border compliance have a clear competitive advantage over institutions that struggle to comply with cross-border banking regulations.

9 real-world scenarios in which digital cross-border compliance creates value

Country-specific regulatory requirements make providing cross-border financial services challenging. Let’s look at some real-world examples where compliance software can add value.

1. Creating marketing materials

Complex regulatory restrictions and cumbersome compliance review processes prevent sales and marketing teams from efficiently creating tailored sales materials with customised offerings for clients across borders. Investment disclaimers and risk warnings are gaining in importance. With the right tool, it is easily possible to provide regulatory requirements directly into marketing and sales teams’ tools, reducing the time for putting materials together and enabling them to remain agile in a highly regulated environment.

2. Preparing client meetings

Regulatory complexity burdens planning and documenting client meetings to the point where client’s needs can no longer be met. Actionable answers on the most pressing regulatory issues surrounding client meetings enable relationship managers to realise more client interactions at greater certainty.

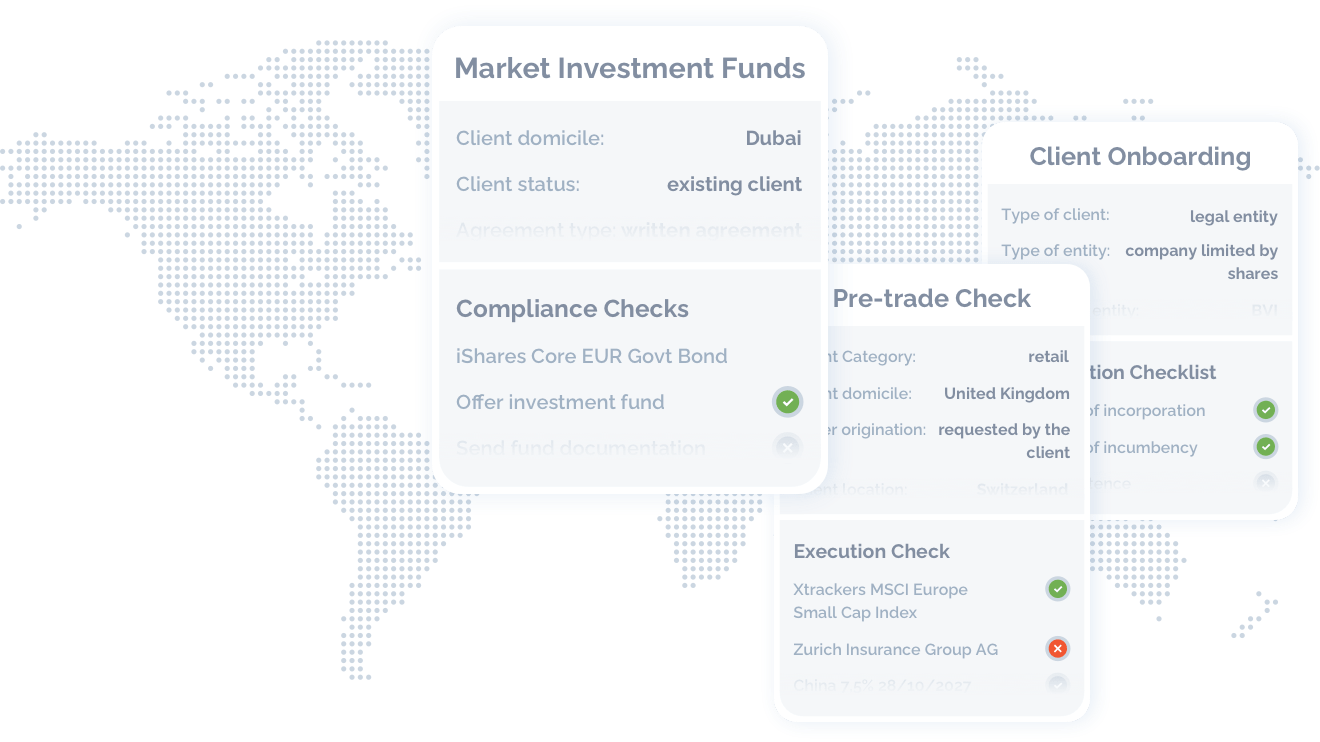

3. Cross-border fund distribution

Marketing and distributing funds to clients globally becomes ever more difficult. Actionable answers on regulatory issues facilitate cross-border fund distribution, especially when the investors concerned are located in more than one country.

4. Accelerating client onboarding processes

In an increasingly regulated environment, understanding what documentation is required from clients slows down the onboarding process. Dynamic inventories of identification and verification requirements allow financial institutions to perform faster client onboarding processes for both legal entities and natural persons.

5. Compliance training

Financial institutions that offer products and services globally often rely on static and outdated material to train their employees. Dynamic inventories of digital cross-border compliance rules enable financial institutions and 3rd party providers to provide state-of-the-art cross-border compliance training.

6. Investment suitability

Financial institutions are struggling to offer their customers investment products that meet suitability requirements without impacting the speed of their services or the scope of their offerings. Instant answers on global cross-border, investment product and tax requirements empower financial institutions to deliver tailored, compliant investment advice.

7. Displaying online product offerings

Restrictions on the types of financial services and products that can be offered force financial service providers either to minimise their online portfolios or to introduce inefficient hard-coded filters into their websites. Automated compliance checks based on a website visitor’s location and client category allow financial institutions to display tailored, compliant product offerings.

8. Offering tax-efficient products and services

With increasing competition and mounting regulatory restrictions, financial institutions are facing rising demand for tailored advice and targeted products. Digital tax rules empower financial institutions to evaluate and optimise investments for after-tax returns for each individual client.

9. Doing pre-trade compliance checks

Buy and sell orders from clients must be executed immediately, putting pressure on relationship managers and trading desks who cannot neglect regulatory requirements in favour of speed. Instant and accurate pre-trade checks built directly into trade execution systems allow traders and client advisors to respond immediately to customer requests without compromising on regulatory restrictions.

5 most important cross-border compliance reports and resources

Given the importance of cross-border banking and the gravity of the compliance issues involved, it is surprising that the literature on this topic is rather sparse. Here are the most important reports and resources on cross-border compliance that we could find.

1. Cost of Compliance Report 2022

Thomson Reuter’s Cost of Compliance Report is a must-read in the industry. The 2022 report focuses on the challenges that risk and compliance functions within financial services firms are facing in 2022 and beyond.

2. Regulatory Divergence: Costs, Risks and Impacts Report

IFAC (International Federation of Accountants) and Business at the OECD (BIAC) surveyed over 250 regulatory and compliance leaders from major global financial institutions to estimate the costs of divergence in regulation to the global economy.

3. Cross-Border Compliance Report 2022

In our second instalment of the cross-border compliance report, we surveyed more than 70 business and compliance professionals in the financial industry. Read the summary on our blog, download the report, or watch the webinar with EY.

4. FINMA cross-border framework

One of the most important sources on cross-border compliance are the publications coming from the Swiss Financial Market Supervisory Authority (FINMA). FINMA has been very clear for a few years now that it expects financial institutions or their group companies to record, limit and control the risks resulting from the provision of products and services across borders, and that it expects institutions to comply with foreign supervisory law. More on it here and here.

5. Ralf Huber on Simplifying Cross-Border Compliance

In this short talk between Regulation Asia host Elliot Gotkine, Apiax co-founder Ralf Huber and Apiax APAC lead Yvonne Ngai talk about how to simplify cross-border compliance using the help of digital tools and compliance automation.

6 trends in digital cross-border compliance

Innovation doesn’t stop at the delivery of cross-border financial services. Here are 6 trends driving innovation in cross-border banking.

1. Compliance Apps

There’s an app for that – including in compliance. More and more compliance apps are coming to market that provide compliance and business specialists in financial institutions alike with value-added functionality for their daily tasks. Whether it’s replacing traditional country manuals with compliance apps or making compliance training more accessible, there’s no reason apps can’t be helpful in the compliance space, and the growing number of offerings on the market shows just that.

2. Compliance AI based on Explainable AI

Data science and engineering teams around the world are looking for a way to support compliance functions with artificial intelligence. The basic requirements for such compliance AI are clear: It must not be a black box – the crucial keyword here is Explainable AI. And the AI should support but not replace the legal and compliance experts in financial institutions.

3. Digital cross-border compliance frameworks

The pressure to comply with local regulations around the world typically results in a cross-border compliance framework: a proper cross-border framework requires regulatory guidance, like policies and manuals, in addition to compliance training and ongoing monitoring to control risks in cross-border banking. Today, we see a strong shift towards digital cross-border frameworks that combine digital compliance rules with business-friendly user interfaces and full integrations with existing software environments. More and more financial institutions are adopting digital cross-border frameworks.

4. Digital cross-border country manuals

Country manuals provide internationally active financial institutions with the necessary know-how to conduct their cross-border activities in compliance with all applicable rules, regulations, and policies. Read more about the 6 reasons to move to digital cross-border country manuals.

5. Digital compliance officers

With increasing digitalization in the compliance sector, the requirements for compliance functions in banks are also changing. Job ads from large global banks are now looking for rules stewards and regulatory engineers, indicating a clear opportunity for compliance specialists with a knack for technology.

6. ESG

ESG stands for Environmental, Social, and Governance. Investors are increasingly using these non-financial factors as part of their analysis process to identify risks and opportunities. Considering environmental, social, and governance (ESG) issues as part of financial analysis is an important motivation for investment professionals to gain a more comprehensive understanding of the companies in which they invest. Numerous institutions are working to develop standards and define materiality to facilitate the inclusion of these factors in the investment process.